Introduction

In the midst of a global economic shift, U.S. President Donald Trump’s trade tariffs, particularly those imposed on China, have sent shockwaves through traditional financial markets. As the global economy adjusted to these changes, another financial force—cryptocurrencies—has been growing in importance, especially Bitcoin. But what happens when the traditional market faces instability? How do cryptocurrencies, often seen as the new frontier of finance, react to external pressures like trade wars and government tariffs?

This blog post delves deep into the intersection of global trade tensions, tariffs, and the cryptocurrency market, specifically Bitcoin. We will examine the causes of the tariff war, the effects it has on Bitcoin and its surrounding ecosystem, and consider what this means for the future of Bitcoin as a financial asset.

To understand the ripple effect on cryptocurrencies, we must first look at the context of President Trump's tariff policies. Introduced as part of a larger strategy to reduce the U.S. trade deficit and counteract what Trump viewed as unfair practices, the tariffs targeted China and other trading partners. These tariffs, imposed on billions of dollars worth of imports, created friction in global supply chains.

The tariffs, especially on China, had multiple economic consequences:

But what about Bitcoin, a decentralized digital currency unbound by traditional financial systems?

Bitcoin was born out of a desire to create an alternative to traditional financial systems, one that could operate without centralized oversight. Its rise coincided with a growing disillusionment with fiat currencies and government-controlled monetary systems. For many, Bitcoin represented freedom, a hedge against inflation, and a store of value akin to gold.

In recent years, Bitcoin has become increasingly popular, not just as a speculative asset, but also as a safe haven during times of economic turbulence. This has sparked debates on whether Bitcoin could become a mainstream financial asset. During periods of economic instability, investors often turn to alternative stores of value, such as gold or Bitcoin, to preserve wealth.

Bitcoin’s ability to function as a hedge against inflation is rooted in its scarcity; only 21 million Bitcoins will ever be mined. In contrast to fiat currencies, which can be printed by central banks, Bitcoin’s limited supply makes it an attractive asset during times when inflation fears rise.

However, Bitcoin’s volatility—sometimes swinging by tens of percent in a matter of hours—has made it a risky asset. This volatility, while potentially profitable, has also caused some skepticism among traditional investors, who are accustomed to more stable financial markets.

While traditional markets have been disrupted by tariffs, the crypto market is not immune. The volatility caused by the uncertainty surrounding the U.S.-China trade war has had significant impacts on Bitcoin and other cryptocurrencies.

Market Reactions to Economic Instability: As global markets faced volatility due to tariffs, many investors began to consider cryptocurrencies as a form of portfolio diversification. Bitcoin’s decentralized nature offers a hedge against potential downturns in traditional financial markets. As trade wars escalated, Bitcoin’s price began to rise, albeit with its usual volatility.

The Role of Market Sentiment: Much of Bitcoin’s price action is driven by sentiment. In times of global uncertainty, investors often seek safe havens. With the trade war pushing traditional markets into turmoil, Bitcoin and other cryptocurrencies saw a surge in interest. The shift towards digital currencies can be seen as a response to fears about inflation, the devaluation of the U.S. dollar, and political instability.

Tariffs and Mining Operations: Another area where tariffs impact the crypto market is in cryptocurrency mining. Mining Bitcoin and other cryptocurrencies requires specialized hardware, and a significant portion of this hardware is manufactured in China. With tariffs driving up costs on these mining rigs, the cost of mining Bitcoin becomes more expensive, especially for smaller miners who operate on thin margins. This could lead to further centralization of mining operations in areas with lower operational costs.

Bitcoin and Global Trade Tensions: With the tariffs in place, the global supply chain has been under pressure. This tension might drive more businesses to consider alternative financial systems, such as Bitcoin, to sidestep restrictions on traditional currencies. This is especially true for businesses in countries where currency devaluation or inflation is a concern.

The concept of Bitcoin as a "safe haven" is increasingly discussed in financial circles. Just like gold, Bitcoin is often seen as a store of value during times of economic distress. But why is Bitcoin considered a safe haven, and how does this relate to Trump’s tariffs?

The Inflation Hedge: Central banks around the world have resorted to printing more money in response to economic slowdowns. In theory, this leads to inflation, which erodes the value of fiat currencies. Bitcoin, however, is immune to inflation in the same way gold is, due to its fixed supply of 21 million coins. As tariffs push inflation fears, more investors are likely to turn to Bitcoin as an alternative.

Decentralized Nature: Unlike traditional currencies, Bitcoin is decentralized, meaning it is not subject to the policies of any single government or central bank. In the face of tariffs and other economic barriers, Bitcoin operates independently, offering investors a way to preserve wealth outside of government-controlled financial systems.

Bitcoin's Growth as a Hedge Against Geopolitical Risks: Geopolitical tensions, such as trade wars, often lead to market instability. Bitcoin’s non-reliance on traditional economic systems makes it an attractive option for those looking to protect their assets from the fallout of such tensions. Over time, this trend may accelerate as global trade conflicts, like those sparked by Trump’s tariffs, continue to influence markets.

As the U.S.-China trade war continues to evolve, so too will Bitcoin’s role in the global financial system. Here are several scenarios that could shape Bitcoin’s future:

Increased Adoption: As tariffs make traditional financial systems more uncertain, Bitcoin may continue to grow as a legitimate store of value. Institutions, large-scale investors, and even governments may start to adopt Bitcoin more frequently as a hedge against fiat currency volatility.

Government Regulation: The growing influence of Bitcoin is likely to prompt governments to regulate it more heavily. Countries might impose their own tariffs or taxes on cryptocurrency transactions. Governments could see Bitcoin as a threat to their fiat currency systems and attempt to regulate it more strictly, which may stifle its growth but also provide a layer of legitimacy.

Technological Improvements: The future of Bitcoin also depends on its technological development. With scalability challenges and high transaction fees being major pain points for Bitcoin, the ongoing development of solutions like the Lightning Network could enhance its use case, particularly in the context of global economic turmoil.

For investors navigating the uncertainties of the crypto market, there are several considerations to keep in mind as they adapt to the effects of tariffs:

Diversification: While Bitcoin may present a safe haven, it remains a volatile asset. Diversification, spreading investments across a range of cryptocurrencies and traditional assets, can help mitigate risk during turbulent times.

Understanding Market Signals: It’s important for investors to understand the signals the market is sending. Monitoring global economic trends, such as tariffs, inflation rates, and government actions, can help investors better predict market movements and make more informed decisions.

Long-Term Perspective: While the tariffs may cause short-term market disruptions, Bitcoin’s long-term trajectory remains promising. Investors should maintain a long-term perspective when holding Bitcoin, understanding that the price may fluctuate but the asset’s value as a store of wealth remains intact.

In conclusion, Trump’s tariffs are not just affecting traditional financial markets; they are also reshaping the cryptocurrency landscape. Bitcoin, with its decentralized and inflation-resistant characteristics, is emerging as a potential safe haven in times of economic uncertainty. However, the tariffs also bring challenges, including rising mining costs and the possibility of increased regulation. Investors must be vigilant, understanding the dynamics of both the global economy and the evolving cryptocurrency market.

As we look to the future, the relationship between government policies, such as tariffs, and cryptocurrencies like Bitcoin will continue to play a significant role in shaping the financial landscape. By understanding these shifts, investors can better navigate the complexities of an increasingly uncertain economic world.

ÜBER DEN AUTOR

Max Mustermann

Max Mustermann ist Experte für Online-Marketing und hat bereits zahlreiche Projekte aufgebaut in denen er sein Wissen unter Beweis gestellt hat. In diesem Blog erfährst du mehr über seine Expertise.

WEITERE BLOGARTIKEL

Dein erfolgreiches Onlinebusiness mit nur einer Software!

Mit FunnelCockpit hast du alle Marketing-Tools in einem System.

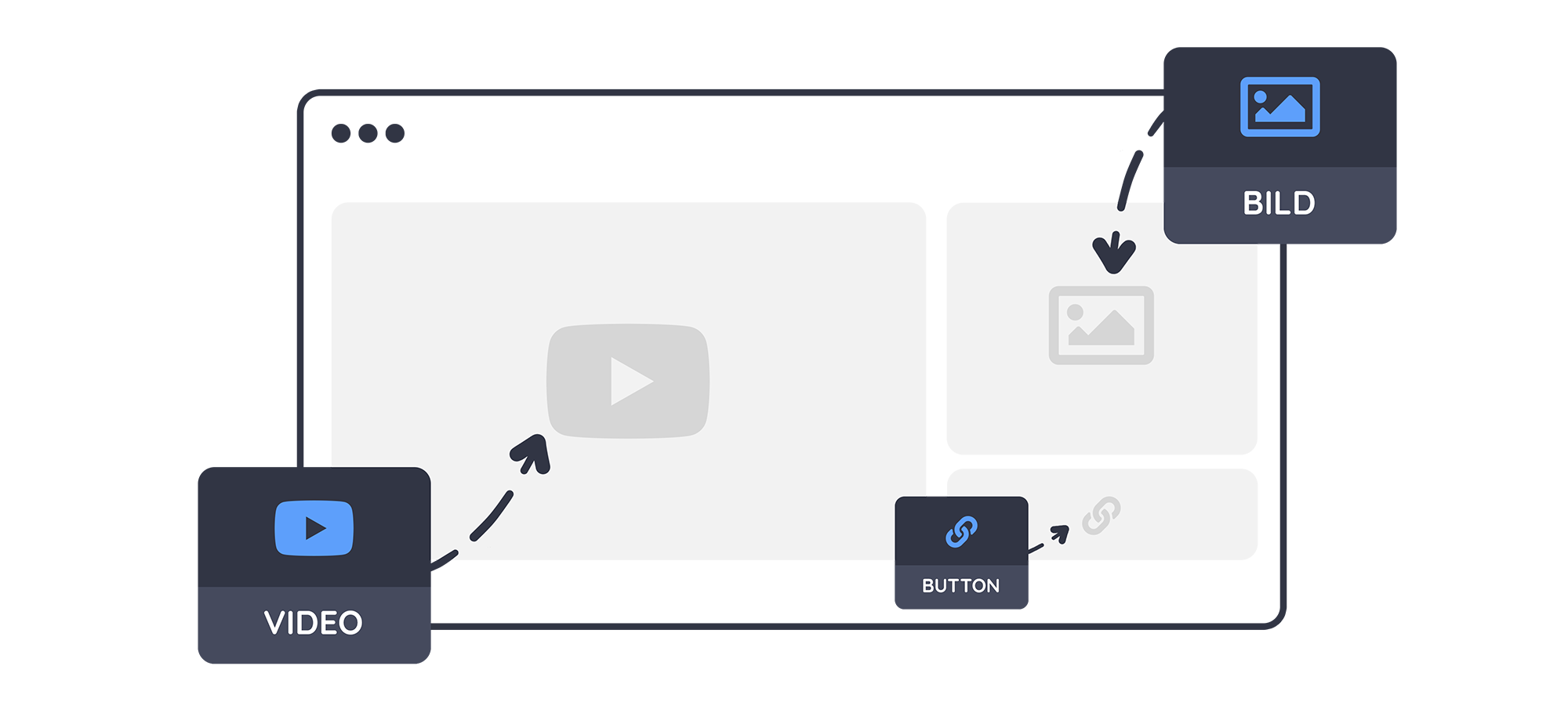

Erhalte Tools wie FunnelBuilder, Splittests, E-Mail Marketing, Webinare, VideoPlayer, Mitglieder-Bereiche und vieles mehr...